iCFO – Financial Analytics &

Business Performance Management

Platform

Unlock your company’s financial potential with iCFO! From expert financial analysis to tailored strategic planning, we’re your partners in prosperity. Maximize profits, minimize risk, and stay ahead of the curve with our cutting-edge solutions. Dive deeper with our sector-specific industry reports and benchmarking comparisons, and let’s elevate your finances together. Explore iCFO today!

Maximize Profitability with iCFO’s Financial Analysis Software

For Professional Advisors:

Financial Data Analytics &

Risk Assessment

Impact clients’ bottom lines and manage their finances with one simple interface. Let iCFO provide you with financial comparisons to your clients’ peers and specific steps to improve upon weaknesses.

For Business Owners:

Industry Benchmarking &

Company Valuation Insights

iCFO shows you how to save money and make more money by showing you key financial ratios for your industry and a personalized roadmap for business improvement and growth.

For Researchers: Financial

Modeling Software & Industry

Analysis Tools

Get an inside look at any industry to see how it is performing and whether that industry is a high or low risk investment for your time or money. The iCFO database covers over 2,500 industries and over 1 million private businesses, so it is simple to find the information you need.

Trusted by Advisors: Why Financial Experts Use iCFO

Benchmarking & Profitability Analysis

Tools for Business Growth

iCFO offers a wide range of business analytics, key performance indicators, reports & practical recommendations, including industry peer benchmarking.

Explore Key Features of iCFO: Financial Ratios & Strategic Planning Tools

Business Performance

Scorecard

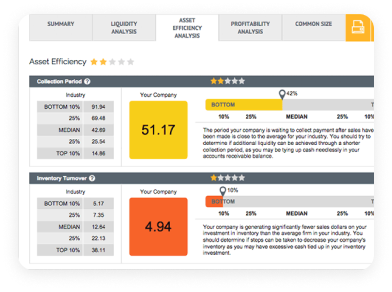

Review a snapshot of your company’s financial state – liquidity, profitability, asset efficiency, and growth – compared to industry peers

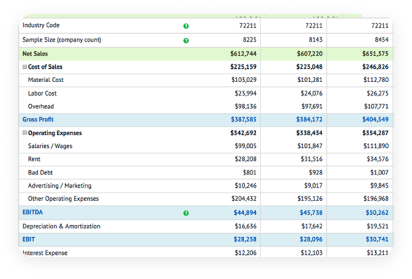

Industry

Metrics

View annual financials, median statistics, charts, ratios and more of your industry competitors or peer groups.

Business

Risk

Review your company’s financial health and its ability to weather typical market fluctuations, accurately determining its viability.

Loan

Risk

Assess a business’s financial viability and its ability to repay new debt obligations, allowing for quick and effective loan decisions.

Liquidity

Analyze your Liquidity position using an innovative proprietary measure determining working capital needs while modeling ways to improve cash sufficiency.

Financial Statement

Spreading

Review your company’s financial health and its ability to weather typical market fluctuations, accurately determining its viability.

Profitability

Evaluate your Profitability performance and model “what-if” scenarios designed to help improve performance and placement amongst industry peers.

Business

Valuation

Evaluate your company’s market value using commonly used valuation techniques aided by insightful comparison to industry peers.

Growth

Potential

Determine a company’s Sustainable Growth Rate and model “what-if” scenarios designedto improve SGR and placement amongst industry peers.