Why You Need Balanced Financial Leverage—and How iCFO’s Industry Benchmarking Helps You Stay On Track

Getting your financial leverage right is a bit like finding the perfect balance on a seesaw. Too much debt, and your business can feel weighed down by interest payments and financial risk. Too little, and you may miss out on opportunities for growth. So, how do you figure out the right balance? That’s where iCFO comes in. With its industry benchmarking tools, iCFO helps you see exactly how your financial leverage compares to businesses like yours—so you can make informed decisions.

What Exactly Is Financial Leverage, and Why Is It Important?

Financial leverage refers to how much debt you use to run your business compared to your equity. The goal? Borrowing money to grow faster, without sacrificing profitability. Sounds good in theory, but if you’re not careful, too much debt can hurt key performance indicators (KPIs) like your return on equity (ROE) and net profit margin. Suddenly, interest payments start to eat into your earnings, and your profitability drops. That’s why it’s crucial to strike a balance between debt and equity, so you’re not overextending yourself.

The challenge is that this balance looks different for every industry. A construction firm will have a different debt-to-equity sweet spot compared to a software company. That’s where iCFO’s benchmarking tools become a game-changer.

How iCFO’s Benchmarking Keeps You in Check

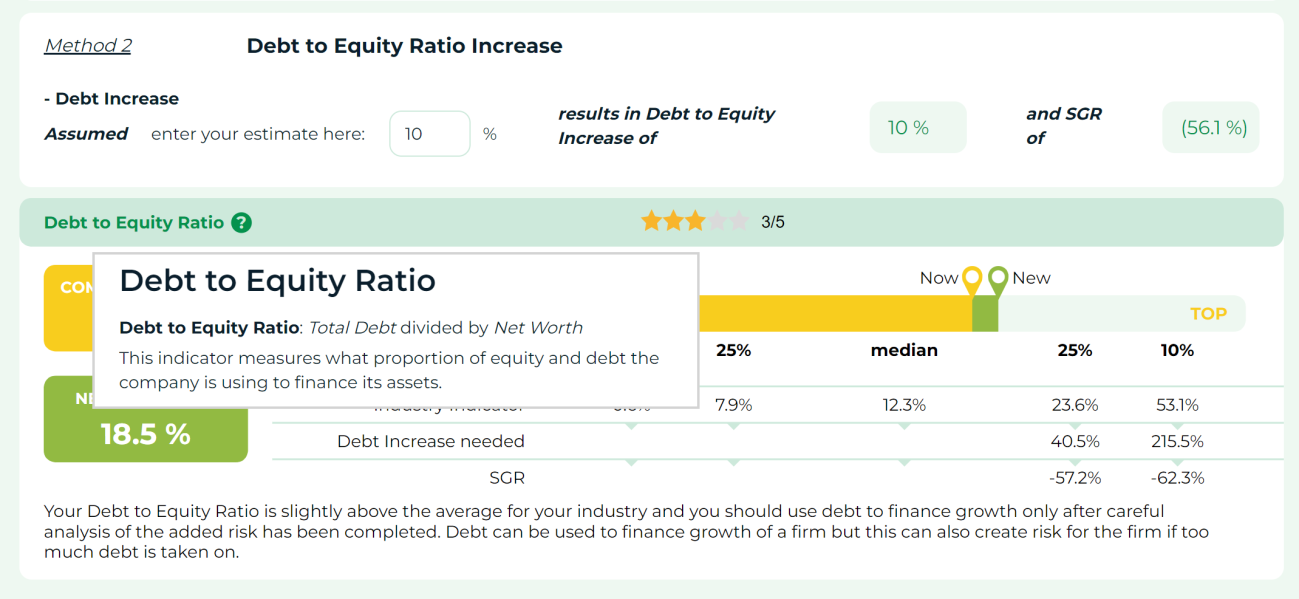

iCFO offers a powerful tool for businesses looking to compare their Total Liabilities to Equity, and Current Liabilities to Equity ratios with industry peers. By providing a full range of benchmarking data, including these Debt to Equity ratios—showing the Bottom 10%, Bottom Quartile, Median, Top Quartile, and Top 10%—you can see exactly where your business stands. This gives you insight into whether your financial leverage is in line with industry norms or if you’re taking on too much (or too little) debt.

For example, if your Debt to Equity ratio falls in the Bottom 10% compared to competitors, you may be playing it too safe. On the other hand, if you’re in the Top 10%, it could be a signal that you’re over-leveraged, which might put your business at risk if market conditions change. iCFO helps you make these comparisons so you can adjust your financial strategy accordingly.

Balancing Leverage with Profitability and Risk

Knowing how your Debt to Equity ratio stacks up against the competition can make a huge difference when it comes to managing risk and growth. Too much financial leverage can lead to lower ROE and a drop in net profit margin, especially as interest costs pile up. But if you’re not taking advantage of the right amount of leverage, you could be missing out on growth opportunities that could boost your asset turnover and overall financial performance.

By benchmarking against a full spectrum of data points—from the Bottom 10% to the Top 10%—iCFO gives you a clear picture of where you fit within your industry. Whether you’re in the middle of the pack or pushing the limits on either end, these insights can help you maintain a balance that supports both profitability and financial sustainability.

Final Thoughts

Achieving the right level of financial leverage is critical to your business’s long-term growth and stability. With iCFO’s industry benchmarking, you can see where your business stands on the spectrum of leverage compared to others in your industry. This data empowers you to make smarter decisions—whether that means adjusting your Debt to Equity ratio or maintaining your current strategy.

At the end of the day, balanced leverage isn’t just about managing risk—it’s about unlocking your business’s full growth potential. And with iCFO’s benchmarking, you have the tools to keep your business on the right track.