iCFO – Industry Benchmarking &

Financial Research

Platform

at Your Fingertips

One-Year & Four-Year

Financial Ratios for

Industry Trend

Analysis

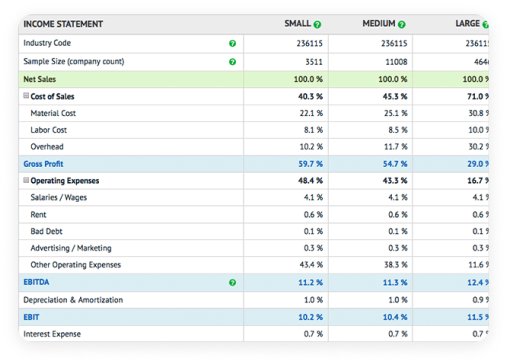

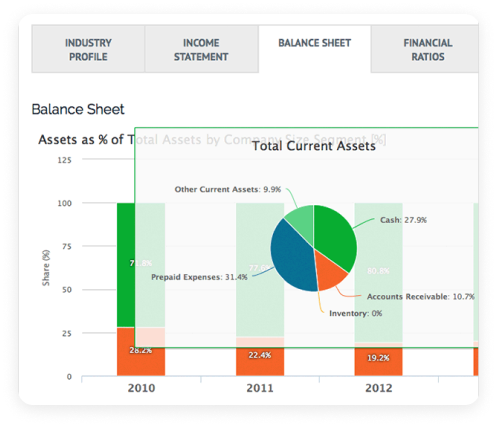

View financial trends for your industry and understand how important accounts and ratios get impacted across different company sizes.

Reports $99 – $149 each.

Download Free Sample 1-year Report and 4-year Report

Use Regional & Sector

Analysis for Accurate

Financial Benchmarking

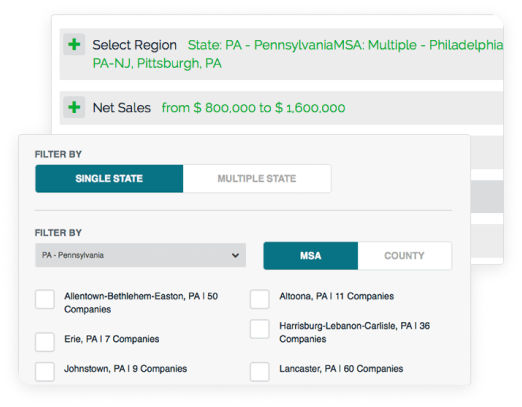

Perform a Regional Analysis for any report type, by selecting State, County, Metropolitan Statistical Area, or customizable cluster. Ensure relevant companies are used in your analysis by setting parameters in Net Sales, Total Assets, Age of Firm, and Number of Employees.

Benchmarking &

Financial Research

Tools for Business and Market Insights

iCFO offers a wide range of business analytics, key performance indicators, reports & practical recommendations, including industry peer benchmarking.

Included Features: Industry Statistics, Sector Analysis, and Ratio Reporting Tools

Business Performance

Scorecard

Review a snapshot of your company’s financial state – liquidity, profitability, asset efficiency, and growth – compared to industry peers

Industry

Metrics

View annual financials, median statistics, charts, ratios and more of your industry competitors or peer groups.

Business

Risk

Review your company’s financial health and its ability to weather typical market fluctuations, accurately determining its viability.

Loan

Risk

Assess a business’s financial viability and its ability to repay new debt obligations, allowing for quick and effective loan decisions.

Liquidity

Analyze your Liquidity position using an innovative proprietary measure determining working capital needs while modeling ways to improve cash sufficiency.

Financial Statement

Spreading

Review your company’s financial health and its ability to weather typical market fluctuations, accurately determining its viability.

Profitability

Evaluate your Profitability performance and model “what-if” scenarios designed to help improve performance and placement amongst industry peers.

Business

Valuation

Evaluate your company’s market value using commonly used valuation techniques aided by insightful comparison to industry peers.

Growth

Potential

Determine a company’s Sustainable Growth Rate and model “what-if” scenarios designedto improve SGR and placement amongst industry peers.