How Industry Reports Drive Smarter Business Decisions

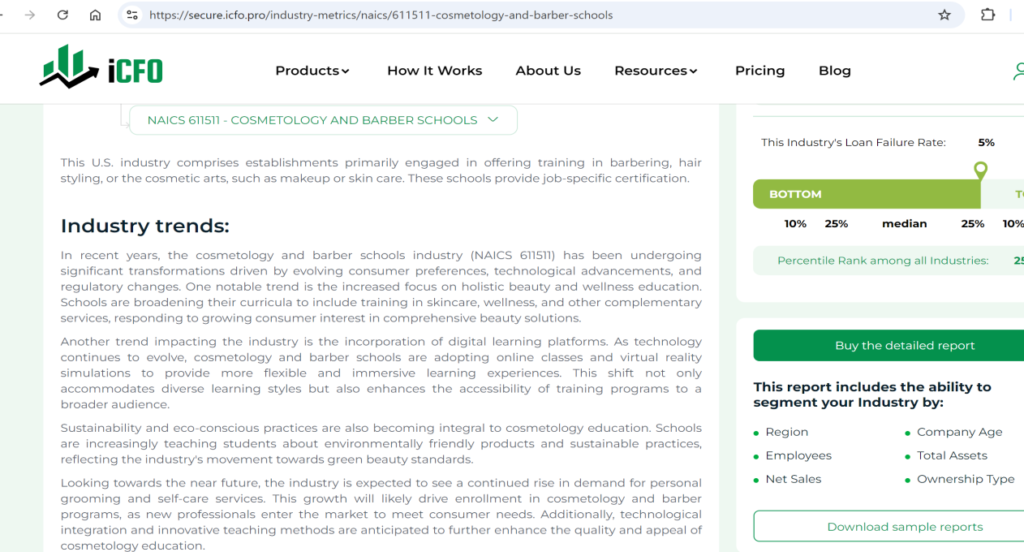

In today’s competitive landscape, relying on instincts alone can’t fuel sustainable growth. To thrive, businesses need data-driven strategies, and industry reports are an essential tool for making smarter, well-informed decisions.

Why Industry Reports Matter

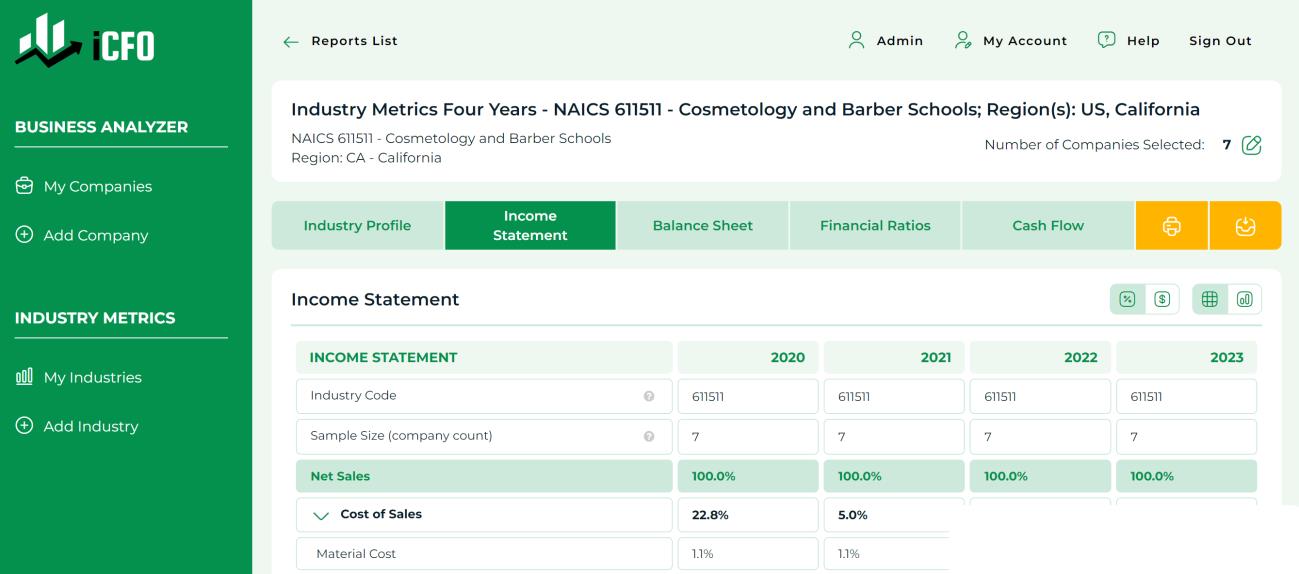

Running a business without data is like driving without a map. Industry reports provide insights into market trends, financial performance, and competitor benchmarks, guiding your decisions with precision. Whether you’re measuring net profit margins, EBIT, or return on equity (ROE), industry reports offer a clear snapshot of your business’s health compared to the market.

For instance, you might think your net profit margin is solid, but how does it compare to top competitors? Benchmarking your performance using these reports helps you assess whether your current strategies are working or need adjustment.

Key Financial Metrics to Track

Not all industry reports are created equally, so it’s important to focus on key financial metrics that matter. Some critical indicators to keep an eye on include:

- Net Profit Margin – Understand how much of your revenue is turning into profit. Compare this against your industry peers to gauge performance.

- Return on Equity (ROE) – A high ROE means you’re using shareholder investments efficiently. But benchmark this figure to see if it’s competitive.

- EBIT – A vital measure of operating profit, EBIT offers clarity on the health of your business operations.

- Asset Turnover Ratio – This shows how efficiently you’re using assets to generate revenue. A low ratio signals inefficiency.

Benchmarking: Measuring Up Against Competitors

Benchmarking is one of the most valuable aspects of industry reports. These reports allow you to see how your business stacks up against others, from key players to smaller competitors. If your fixed asset turnover is low, for example, it might signal inefficient use of resources compared to the industry standard.

Knowing where you rank empowers you to make targeted improvements, whether in cost control, pricing strategy, or operational efficiency.

How to Use Industry Reports for Profitability

Once you have the data from your industry report, the next step is applying that information. Here are a few strategies to boost profitability:

- Cost Management – Review where you’re overspending and find ways to cut unnecessary costs, increasing net profit.

- Adjust Pricing – Use market data to align your prices with demand while maximizing profit margins.

- Boost Sales Volume – Leverage market trends from industry reports to drive targeted marketing efforts and increase sales.

- Improve Efficiency – Streamline operations to improve your fixed asset turnover ratio, ensuring your resources are used more effectively.

Choosing the Right Industry Report

It’s critical to choose the right report for your business needs. Make sure the report is relevant to your industry, provides detailed data, and includes comprehensive benchmarking against competitors.

Real-Life Success: How Industry Reports Drive Growth

Businesses of all sizes benefit from industry reports. For example, a small retail company might use these reports to optimize its supply chain, reducing costs and improving profit margins. Meanwhile, a startup could leverage the data to spot emerging market trends, allowing them to pivot early and seize new opportunities.

Conclusion

In today’s market, informed decisions are essential to success. Industry reports provide invaluable insights into your business’s performance and help you measure up against competitors. Armed with data on net profit margins, ROE, and other key metrics, you can make smarter decisions that boost profitability and growth.

Ready to make data-driven decisions? Explore our industry reports today and equip your business with the insights needed to thrive in a competitive market.