The Superiority of Return on Asset Investment (ROAI) in Measuring Business Earnings Power

In today’s dynamic financial environment, businesses seek reliable metrics to assess their performance. Return on Asset Investment (ROAI), developed and taught by the co-founder of FINTEL Dr. Robert W. Pricer in his entrepreneurship classes at the School of Business of UW-Madison, stands out for its comprehensive approach to evaluating a company’s earnings power, especially amid rising interest rates.

Understanding ROAI

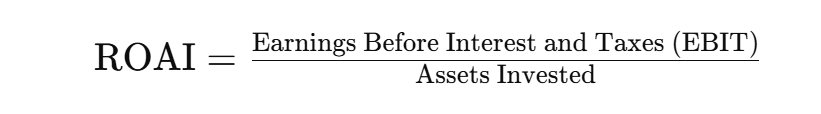

ROAI measures how efficiently a company generates profits from its invested capital, including both equity and debt. It is calculated as:

Here, Assets Invested equals shareholder equity plus interest-bearing debt, offering a holistic view of a company’s operational efficiency.

Why EBIT?

EBIT is crucial to ROAI as it isolates operational performance from the effects of interest and taxes, providing a clearer picture of core profitability. This allows for uniform comparison across companies with varying capital structures and tax situations.

The Rising Importance of ROAI

With increasing interest rates, small businesses face higher borrowing costs. Dr. Pricer emphasizes the critical role of ROAI in helping businesses assess their ability to generate sufficient earnings to cover these costs. The current average interest rate for small businesses has risen significantly, highlighting the need for accurate profitability measures and to ensure an appropriate spread between earnings on debt and cost of debt.

Comparing ROAI with Other Metrics

- Return on Equity (ROE):

- ROE measures profitability relative to shareholders’ equity but can be skewed by debt levels. ROAI offers a more comprehensive view by considering total assets, providing a clearer picture of overall efficiency.

- Return on Investment (ROI):

- ROI evaluates investment gains but does not account for the time value of money or differentiate between short- and long-term returns. ROAI provides a precise analysis by focusing on asset utilization over a specific period.

- Net Profit Margin:

- While net profit margin indicates profit per dollar of revenue, it does not reflect asset efficiency. ROAI fills this gap by linking profits to total asset investment, offering insights into asset utilization efficiency.

The Predictive Power of ROAI

ROAI’s ability to predict future viability is a significant advantage. By comparing ROAI to the cost of debt, businesses can gauge their ability to cover interest expenses and remain profitable. Dr. Pricer suggests that ROAI should exceed the cost of debt by at least 2% to ensure financial health. For example, if a company has an ROAI of 18.62% and a cost of debt of 4.44%, the 14.18% spread indicates strong financial stability. However, every industry has unique challenges, and industry peer benchmarking data is an important addition to any analysis of profitability, or otherwise.

Management Insights and Decision Making

ROAI provides valuable insights for management. Comparing ROAI with industry benchmarks helps identify areas for improvement and inform strategic decisions. Strategies such as increasing prices, boosting sales, or reducing expenses can enhance ROAI, thereby improving overall financial health.

Utilizing SaaS to automate ROAI with Industry Peer Benchmarking

Software-as-a-Service (SaaS) helps leverage automation of profitability measures and more, including the more common ratios and advanced, like ROAI. iCFO Pro combines the traditional metrics with more in-depth assessments with financial modeling that includes data from industry peers, so that each company analyzed is compared to relevant trends and metrics, parsable by custom net sales ranges, total assets, region and more.

Conclusion

ROAI stands out as a superior measure of earnings power due to its comprehensive approach, focusing on operational efficiency and the entire asset base. Its relevance becomes even more pronounced in a high-interest-rate environment, offering businesses a clear, actionable metric to guide financial decisions and ensure long-term viability. Understanding and leveraging ROAI, as taught by Dr. Robert W. Pricer, is essential for businesses aiming to thrive amid financial challenges, with continuity of monitoring in analysis helpful for optimizing financial health and safety.